The South African Reserve Bank's Monetary Policy Committee has raised the repo rate by a further 50 basis points to 8.25%, leaving the prime lending rate at 11.75% - the highest it has been since 2009.

Rate hike an economic killjoy and burden for homebuyers

The decision by the Monetary Policy Committee of the SA Reserve Bank to hike the repo rate for the 10th time in just two years by another 50bps is a huge burden for consumers and homebuyers, says Samuel Seeff, chairman of the Seeff Property Group.

The hike takes the repo rate to 8.25%, and the base home loan rate to 11.75%. Seeff says the direct effect on homeowners and buyers is that the cost of borrowing has risen drastically over the last two years.

He says there was adequate reason for the Bank to have taken a more dovish stance in view of the current economic climate. The rate hike is a killjoy for the struggling economy, especially in view of the fallout from the Eskom energy crisis, and the market needs positive news.

While the deterioration of the currency is a concern, it is largely expected to return to a more manageable level while the reduction of the CPI to 6.5% now puts it only slightly above the Bank's target range. The higher inflation is in any event not demand driven, and Seeff believes that consumers should not be punished with another rate hike.

What does the higher interest rate mean for the housing market?

Seeff says the rapidly rising borrowing cost has put a dampener on the market. First-time homebuyers, many from the emerging middle class, are facing affordability challenges, and overall sales volumes have declined, more in some areas and to a lesser degree in other markets such as the Cape.

That said, the rate is still below the average of 15% to 16%. It is also encouraging for the market that we are still seeing the best lending conditions since 2007 with strong support from the banks. Approval rates are still at over 80%, deposit requirements still at around 8%-10%, and buyers can often find a rate concession.

Seeff says prequalification for buyers is vital to ensure they are not disappointed, but to also put them in a better negotiating position. Sellers on the other hand should note that house price growth has stalled which means they need to ensure they price correctly if they are looking to sell right now. Buyers will be pressing and since they do not have to compete with too many other buyers will be looking for price concessions.

As a result of the latest 50bps interest rate hike, monthly bond repayments over a 20-year term will increase by approximately:

R750 000 bond - extra R259 from R7 869 to R8 128

R900 000 bond - extra R310 from R9 443 to R9 753

R1 000 000 bond - extra R344 from R10 493 to R10 837

R1 500 000 bond - extra R517 from R15 739 to R16 256

R2 000 000 bond - extra R689 from R20 985 to R21 674

R2 500 000 bond - extra R862 from R26 231 to R27 093

Consumers feel the pinch as interest rates rise again

Debt holders are sure to feel the pinch following the latest announcement by the Monetary Policy Committee (MPC)- the highest it has been since 2009.

Unsurprised by this announcement, Regional Director and CEO of RE/MAX of Southern Africa Adrian Goslett says that managing debt will become a challenge going forward. This interest rate hike might push many consumers beyond what they can afford. "We have already noticed the shift in the property market where we are receiving more enquiries from sellers and less interest from buyers. Every interest rate hike reduces consumers' spending power and their affordability levels get placed under further pressure. A hike like this is likely to cause activity within the property market to tighten even further," says Goslett.

Following the latest hike, Goslett adds that good real estate professionals should be strongly encouraging their buyers to get preapproval before starting the house hunting journey to make sure they avoid the disappointment of discovering that they are unable to afford their dream home.

"Sellers should also guard against any real estate professional who tries to overprice the home just to land the sole mandate, as this can be detrimental to the sale, especially during this time. Find out what similar homes are selling for in the area and use this as a guide when setting an asking price. If an agent proposes a price that is way over the average selling price in your area, then it is unlikely to be fair market value for your home," says Goslett.

Always be prepared

"Most experts were hopeful leading up to the March announcement that the hiking cycle might be near its end. The current sentiment seems to point to this being the last hike in the cycle, but there is no guarantee of this as inflation continues to fluctuate from meeting to meeting. My advice to consumers is to always be prepared for at least a bump of 25 basis points at any point in time, as this will prevent them from being caught off guard," he recommends.

As a final word of advice, Goslett encourages struggling consumers to reach out for help before things get too out of hand. "If you are struggling, the worst thing you can do is nothing. Arrange a free consultation with your local RE/MAX agent to find out how your local market is performing and what options exist that might improve your current financial position," says Goslett.

Series of unfortunate events precipitate further repo rate hike

"At the time, the higher-than-anticipated 50bps rate hike at the previous (March 2023) MPC meeting was widely thought to be the last - or at worst the penultimate - repo rate hike in the current interest rate cycle. Not only had interest rates risen beyond their pre-Covid highs of 10.25% but severe loadshedding was causing a rapid deterioration in the local economic outlook," says Dr. Andrew Golding, chief executive of the Pam Golding Property Group.

Unfortunately, the upside risks to the inflation outlook that the Reserve Bank highlighted at last month's MPC materialised, compelling the Bank to hike rates by a further 50bps at the May meeting. With a number of local factors continuing to pose further upside risks to the inflation outlook, there is now less certainty that rates are now finally at a peak.

Positively on the global front, inflationary pressures are showing increasingly reassuring signs of abating, while here in South Africa, headline consumer inflation (according to the Consumer Price Index - CPI) eased to 6.8% in April - down from 7.1% in March.

Notwithstanding this, Rand weakness and loadshedding are fuelling local costs and limiting the extent to which we could potentially benefit from lower global food and energy prices.

While the Reserve Bank acknowledges that interest rates are not the ideal mechanism for containing inflation, the Bank is being forced to act alone - raising interest rates in a zero-growth economy in an attempt to prevent rising inflation expectations from becoming entrenched.

What does this mean for homeowners?

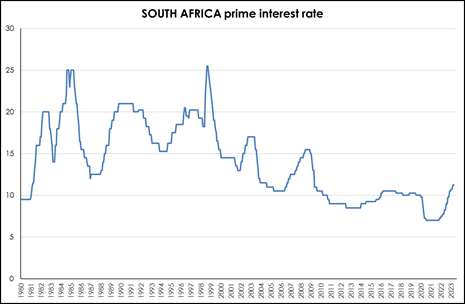

South Africa has weathered far higher interest rates in the past (see graph below), and when adjusting for inflation, the real prime rate is not as high as it was prior to the pandemic. Despite this, the higher interest rate will undoubtedly provide a challenge for the many first-time buyers who capitalised on the low rates during the pandemic in order to gain a foothold in the property market.

Against the backdrop of the current lacklustre economic outlook for South Africa, with loadshedding in particular weighing on growth prospects - especially as we head into winter- and fuelling inflation, given the considerable cost of energy alternatives such as generators and diesel used by retailers and the like, which are ultimately to be passed on the consumers, pose significant headwinds to the property market. However, people, especially young adults, require homes and many need to move to economic hubs which offer employment opportunities or a sustainable and secure life for families.

Recent Pam Golding Properties research showed that even as overall housing activity slowed, sales in major metro areas have remained buoyant, as young adults continue to be attracted to key business nodes to start careers and ultimately purchase homes.

While employment prospects ensure the enduring appeal of housing markets in all major metro nodes, lifestyle considerations continue to encourage relocation by those who are able to, to destinations, including smaller towns, where the way of life is more appealing and house prices are more affordable.

In terms of lifestyle playing a role in purchasing decisions

There is still a strong preference for coastal properties (within 5km of coastline) - as highlighted by the still widening coastal price premium, which is seeing house price inflation for coastal properties exceed that of non-coastal properties since late-2020 (latest Pam Golding Residential Property Index).

The appeal of sustainable municipalities is clear in the surge in investment/buy-to-rent demand in the Western Cape, indicating that even if homebuyers are not able to move immediately, there is a groundswell of those who wish to participate in the Western Cape housing market with a view to retire or relocate there when possible - or at least to benefit economically from the still buoyant Western Cape housing market.

At the top-end luxury sector of the residential property market, and despite the current constrained economic trading conditions, there are several niche markets in prime nodes which continue to attract affluent buyers from around the country. These include Tshwane, Johannesburg - such as Sandhurst and Hyde Park, Steyn City in Fourways, Durban - including Morningside, Westville, uMhlanga and Brighton Beach, and Ballito/Zimbali, as well as the Western Cape - including the Garden Route. Furthermore, the top-end of the Cape market has shown itself to be resilient and insulated to some degree from the rest of the market with international buyer demand in this segment featuring prominently."

Interest rate hike a reality check

All is not doom and gloom despite today's announcement by the Reserve Bank that interest rates will be hiked by a further 0,5% says Tyson Properties CEO, Nick Pearson.

Ask if he expects a panic sell off of homes, a surge in bank reclamations and auction boards popping up on suburban pavements, and you'll get a resounding no. People still have some room to make adjustments and banks have been consistent in their willingness to assist customers to ride out economic storms over the past couple of years. This is not likely to change, in his opinion.

Although he is sensitive to the fact that consumers - and, in his case, potential home buyers - are under immense pressure with household disposable income seeming to shrink almost monthly, he remains optimistic that a lot of good could come out of this latest adjustment.

Describing the local property market as one that's been at an impasse for some time with buyers pricing their properties at between 10 and 20% above the amounts that most sellers are prepared to pay and properties remaining on the market for longer than they should, Pearson says this latest interest rate hike could be the reality check that South Africa's residential property market needs.

"Closing the gap between buyers and sellers could even inspire more transactions further down the line. It always does. The market may dip for a month or two but, as more and more people are prepared to sell their houses at more realistic prices, the market will become active again," he says.

Pearson points out that there are always buyers in the market and that the present market favours them. "Buyers are effectively getting a 10% discount on an investment. There are a lot of people who make a lot of money in tough markets because they can find those once-in-a-lifetime opportunities. Good business people will still be buying," he says.

He adds that buyers, too, May benefit from that all-important reality check and revise their expectations downwards based on affordability. "It is often hard for the next generation of home buyers, who should be entering the market right now, to find houses at the right price. Things always seem to be just out of reach. This might be the opportunity for them to find a home at a better price and to enter the market. So, a drop in house prices might not be the worst thing in the world for the South African economy in general."

He also believes that South Africa can be roughly divided into two distinctive property markets that will react completely differently to the latest interest rate hike. Firstly, there's Cape Town where the buoyant market will be less sensitive to repayment rates as pent up demand from the many buyers relocating from other provinces coupled with ongoing international investment from Europe and the United Kingdom, keeps prices strong. Many of these investors are cash buyers.

Then there's the rest of the country.

Pearson believes that the KwaZulu-Natal market, which offers both the best value and the best lifestyle, will be the most resilient and bounce back from what will be viewed as a temporary setback.

In Johannesburg, where the market has been suppressed for some time with too many properties on the market, this could be the long awaited tipping point that pushes prices downward and re-ignites activity.

Overall, Pearson urges South Africans to view the latest rates hike in the context of the widespread global economic downturn which is seeing interest rates moving upwards in both developed and developing economies. For the most part, this hasn't put a lid on buying.

"We can't deny that the world is going through a tough time. There's a war going on in the Ukraine, like American politics, South African politics is challenging. There are problems wherever you look. Where there's poor leadership, people struggle," he suggests.

But, as has been proven in the past, economics and related market trends are cyclical and there is always a recovery. He remains confident that, as South Africa works out its energy woes and the hugely under-valued rand strengthens once more, there will be a lot of gains.

"It's certainly a hugely speculative market. I look at the market right now as a good time to be buying property, to be buying and growing businesses. It is exciting," he says.

"Ongoing struggle to curb inflation"

The extended hike cycle is widely attributed to the Monetary Policy Committee's ongoing struggle to curb inflation, which remains stubbornly outside of its target range of 3% to 6%.

"South Africans are battling rising costs on every front, from food to fuel to home finance," says David Jacobs, Regional Sales Manager for the Rawson Property Group. "After the last rates hike, we were optimistic that we'd finally seen the peak of the current interest rate cycle."

For some homeowners, this latest increase could see their monthly bond repayments tip over the edge of affordability.

"Established homeowners who are a fair way into their loan term will hopefully have a little more financial wiggle room, with several years of income growth behind them," says Jacobs. "More recent buyers, on the other hand - particularly those who purchased at the peak of their affordability during Covid's record-low interest rates - have not had the benefit of time to grow into their bond repayments."

New homeowners hit the hardest

As a result, Jacobs says interest rate hikes are hitting these new homeowners the hardest, forcing some to reconsider the viability of their investments.

"Distressed sales are increasing, but it's important for homeowners to realise that this isn't their only option," he says. "Banks are generally very willing to compromise in order to help otherwise-responsible bondholders through periods of heightened financial distress. The first step for anyone struggling with affordability is to approach their lender to discuss options." There's also an option to let out the property and move back with family or friends, the steady stream of rental can help with the monthly bond.

For those who need - or simply want - to sell, however, Jacobs says the market isn't quite as unfriendly as many make out.

"As long as you price your property accurately and market it well, it's definitely possible to achieve a favourable sale," he says. "The key is to read the room and adjust quickly if you miss the mark. Don't fall into the trap of letting your property stagnate on the market because you're unwilling to compromise."

Opportunities are abundant

As for buyers, Jacobs says opportunities are abundant, with plenty of well-priced properties on offer.

"One of the most valuable things today's buyers have is time," he says. "Supply greatly exceeds demand, which means there isn't a lot of competition. You can safely take your time to look around, do your investigations, and find the right spot at the right price without fear of missing out."

Jacobs does stress the importance of getting prequalified, however, to fully understand your affordability picture within the current economic climate.

"It's also not a bad time to look at investment properties," he adds. "The rental market has taken an upturn as buyer affordability has waned, and more people are prioritising financial predictability and lifestyle flexibility over long-term investment potential. That's not to say rental returns are skyrocketing - tenants are also under significant financial pressure - but demand is high and outlooks are positive for solid growth down the line."

https://www.property24.com/articles/sarb-hikes-repo-rate-by-50bps-prime-lending-rate-now-1175/31701